Don't let a failed audit freeze your launch. We provide the compliance-validated engineering teams and Transformation Blueprints you need to secure your license and scale from Seed to Series B.

Powering platforms processing $10M+ monthly. 100% Regulator Audit Pass Rate.

Ledger Drift

across all client platforms.

$0

Audit Pass Rate

with Central Bank regulators.

100%

Average transaction

latency.

<200ms

“We needed to integrate with three different legacy banks in East Africa while keeping our user experience instant. EPixelSoft didn’t just build the API; they architected a queuing system that ensured 99.99% uptime even when the banks went down. They understand the stakes.”

In FinTech and digital banking, the cost of getting it wrong is brutal. A missed requirement, a fragile integration, or an incomplete audit trail can stall licenses, trigger fines, or freeze launches your team has spent months building.

New central bank directives, data protection laws, KYC/AML rules, and card scheme updates are piling up on top of an already complex stack.

Monoliths, quick fixes, and point-to-point integrations make every new feature feel like a risk to stability - and a nightmare to explain to auditors.

Risk teams think in obligations and controls, engineers think in services and APIs. Without a shared blueprint, both sides are frustrated.

Due diligence now goes beyond metrics. They want to know: “Is your platform actually regulator-ready?” Being unsure in that moment is not an option.

If a single regulator says “no”, months of

product work can disappear in a single meeting.

That’s

what we help you avoid.

We decouple risk from development. Start with a fixed-price engagement to validate your architecture before you commit to a full build.

EPixelSoft is your digital engineering partner for compliance-driven FinTech and banking products. We connect regulatory reality with modern architecture, so your teams can move quickly - on a platform regulators and investors can trust.

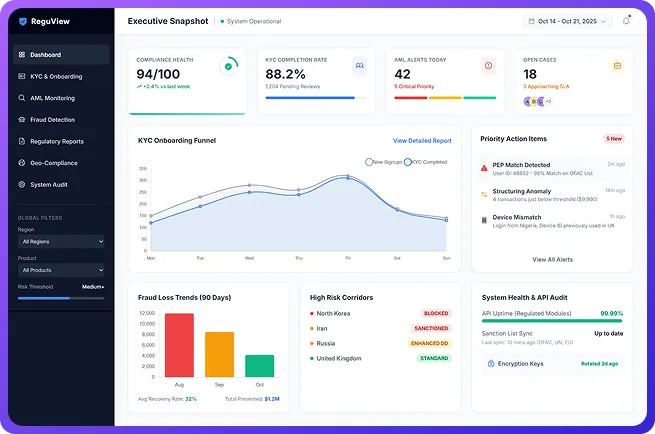

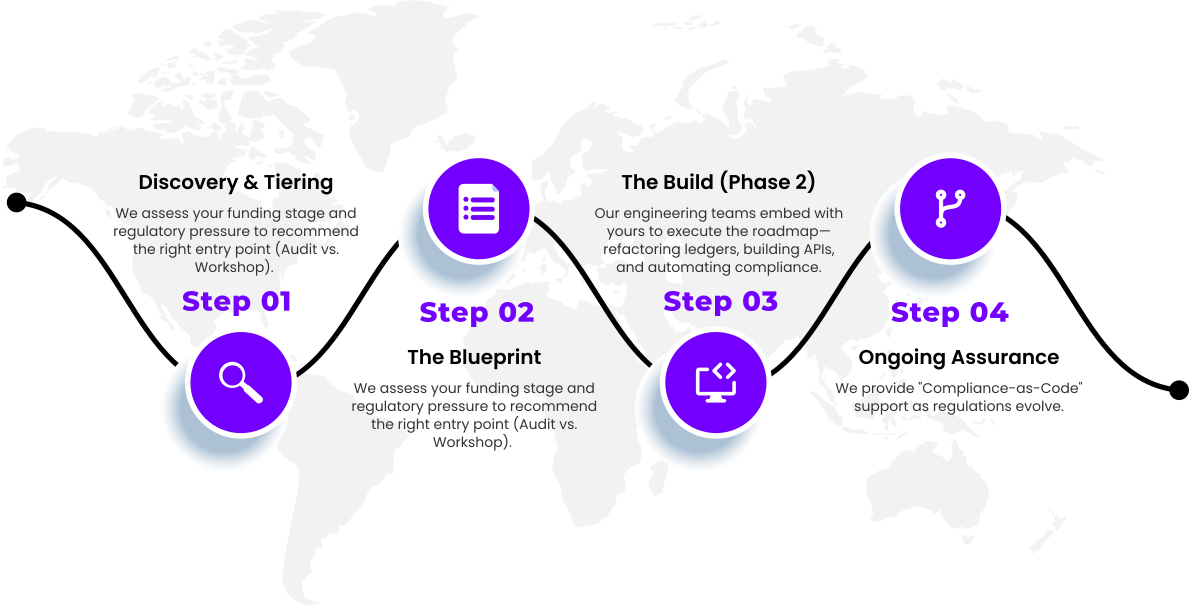

We start with a deep-dive Compliance Architecture Audit. We map your systems, data flows, integrations, and controls against the regulatory and security requirements you’re operating under. You get a clear view of where risk lives in your platform today.

Next, we translate findings into a practical, prioritized roadmap. What needs to be fixed now? What can wait? How do we get you ready for the next regulator review, funding round, or market launch? You walk away with a blueprint the whole leadership team can align around.

Our engineering team helps you execute: refactors, new services, secure integrations, better logging and monitoring, and improved workflows for KYC, AML, and transaction monitoring. We build alongside your team, not instead of them.

Regulation doesn’t stand still. We offer ongoing compliance engineering support so your platform, processes, and documentation evolve with new rules, new products, and new geographies.

We don’t sell hours of development. We help you reduce risk, unlock growth, and create a platform your stakeholders actually trust. The value shows up differently for each role - but it’s all connected.

Compliance shouldn’t be the enemy of innovation. Done right, it becomes

the foundation that lets you move faster and go further.

We keep the process simple, structured, and transparent. Every engagement is designed to give you clarity quickly, then move into focused execution.

Every engagement starts with a fixed-scope Compliance

Architecture Audit.

We work with regulated FinTechs and financial institutions across Africa and the Middle East who need to move fast without gambling on compliance or platform stability.

Building and scaling regulated products under pressure from investors, regulators, and the market, who need to pass due diligence fast.

Launching or expanding app-first banking experiences that must pass strict technical and regulatory scrutiny, and that cannot afford downtime or ledger errors.

Managing credit risk, collections, and regulatory expectations while pushing for growth.

Handling high transaction volumes, settlement, chargebacks, and card scheme requirements that need robust handling of high-concurrency transactions.

Orchestrating complex flows between telcos, banks, and users in real-world infrastructure conditions.

Upgrading legacy systems, launching digital channels, and integrating with FinTech partners - without disrupting core operations.

If you’re building or running a regulated FinTech or banking platform in Africa or the

Middle East, this page - and our work - is designed for you.

We’ve answered some of the most common questions clients ask before starting their journey.

Ready to De-Risk Your Next Release?

Whether you’re preparing for a new license, expanding into a new country, or gearing up for your next funding round, this is the moment to get your architecture and compliance story in order. We’ll help you see the risk clearly, build a roadmap you can trust, and execute without slowing your team down.

Prefer to explore first? Download the Compliance Risk Blueprint

No hard pitch. In our first call, we’ll review your current situation, highlight key risks we see, and suggest practical next steps - whether we work together or not.